This Mitchell Brandtman Quarterly Construction Cost Update

has been put together to help keep you informed on the

movements of the market to better position yourself for your

current and future projects.

For more information, please contact Colin Prince: cprince@mitbrand.com

On November 13th, Mitchell Brandtman Partner

Tass Assarapin led the Financiers’ Construction Market Update Presentation for

our NSW clients, focusing on key strategies for navigating within today’s

construction industry.

Key takeaways included:

Contractor Suitability & Careful Planning: Emphasis was placed on selecting suitable contractors and investing in detailed planning to ensure favourable project outcomes.

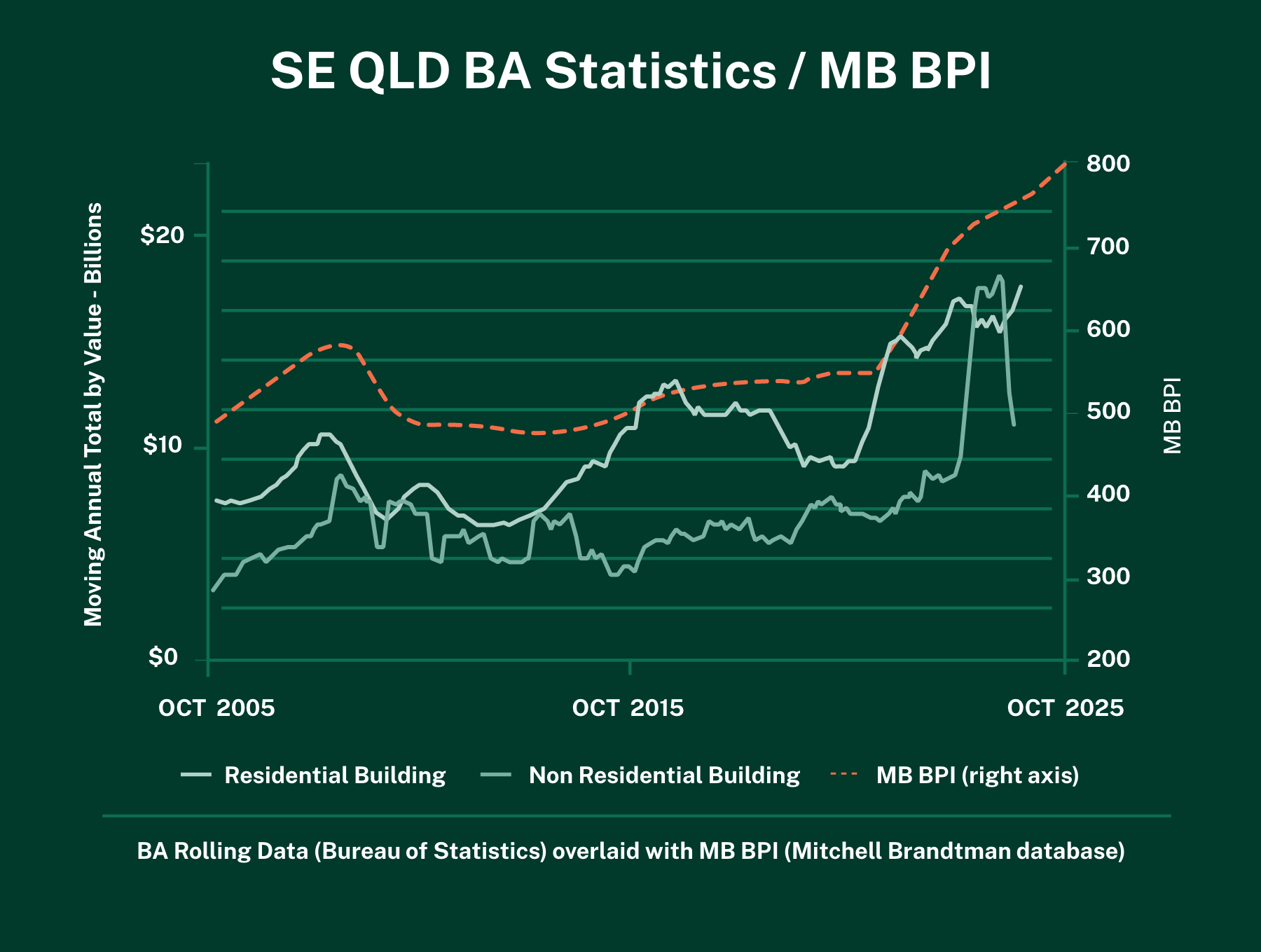

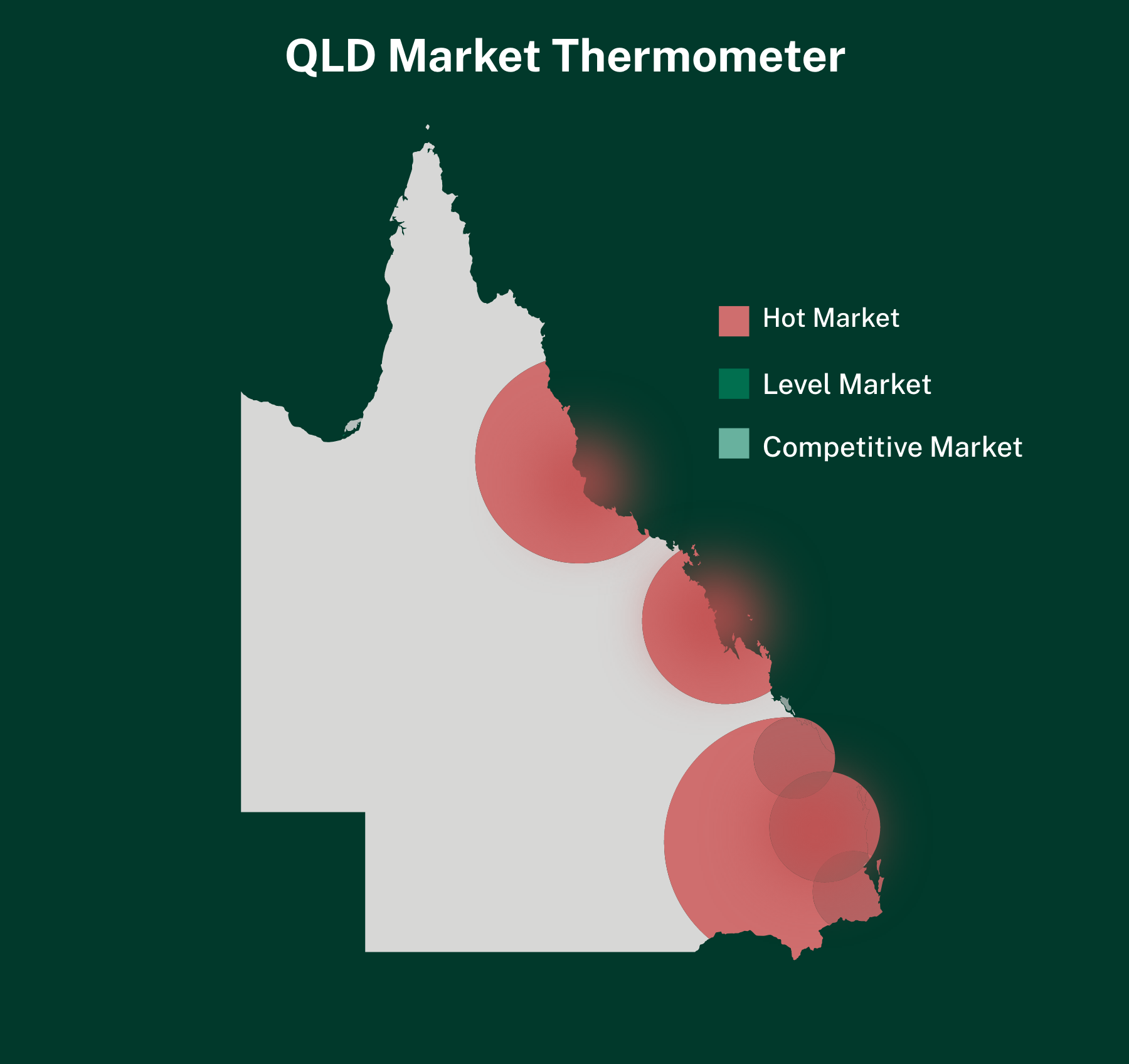

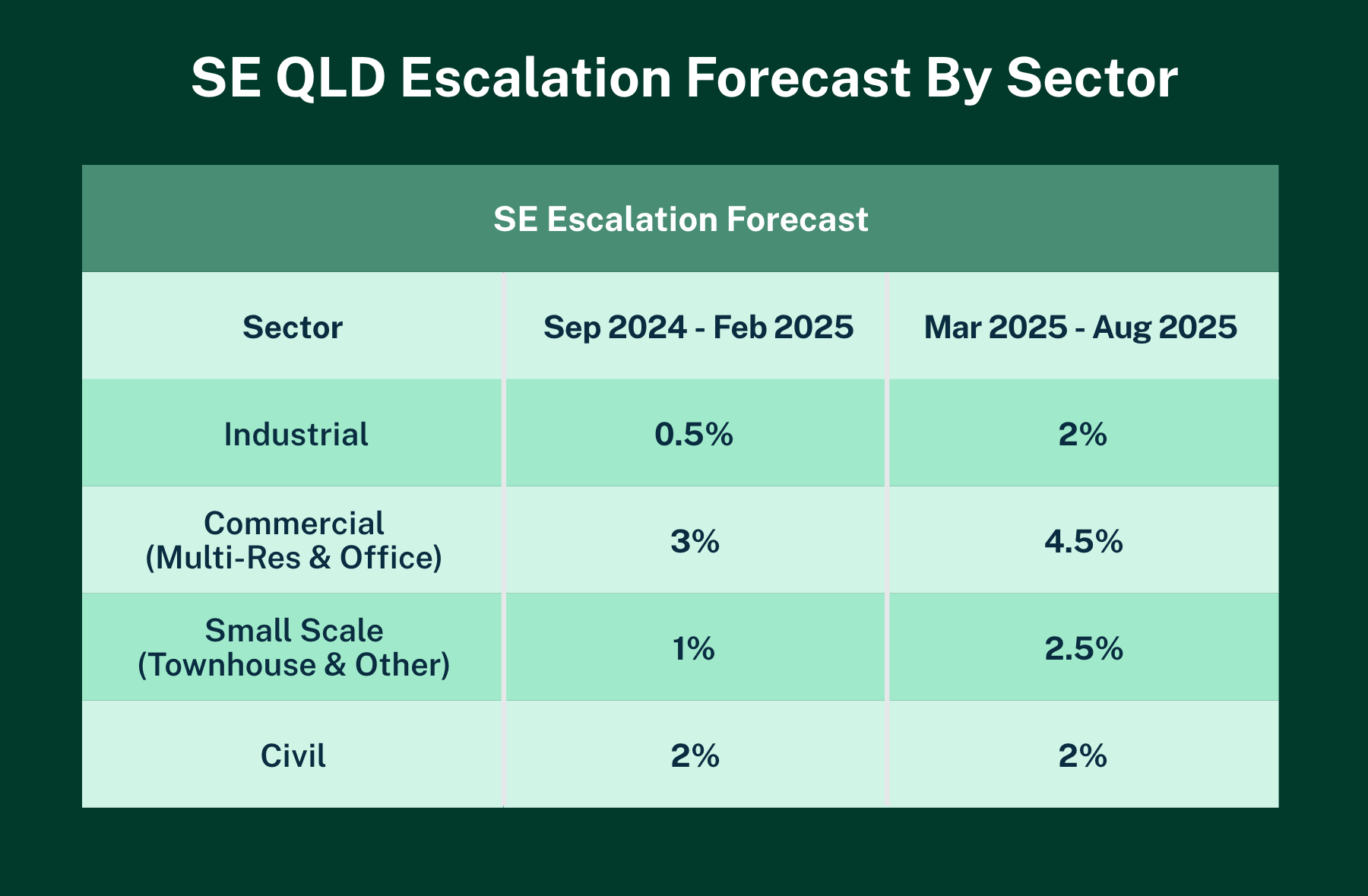

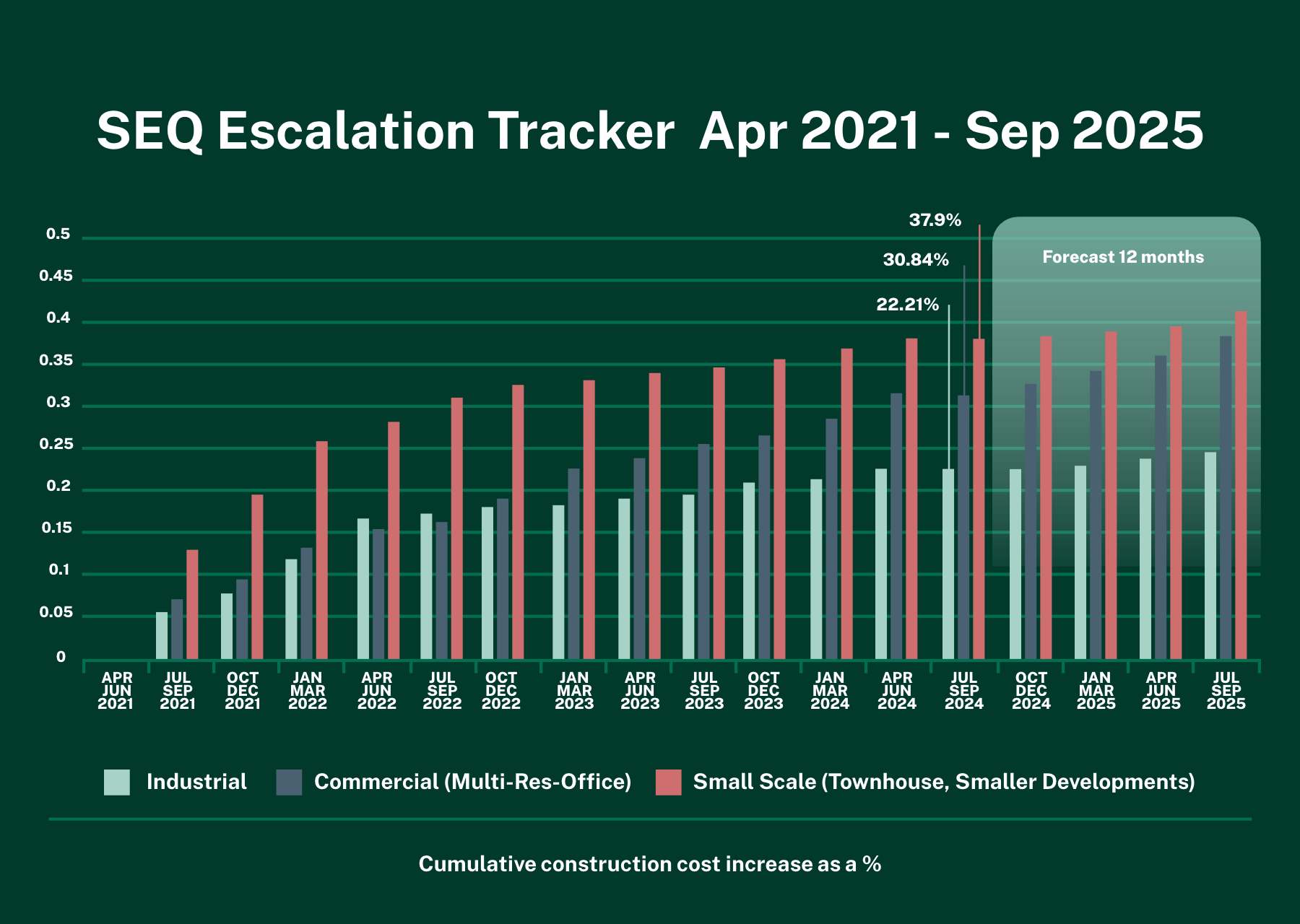

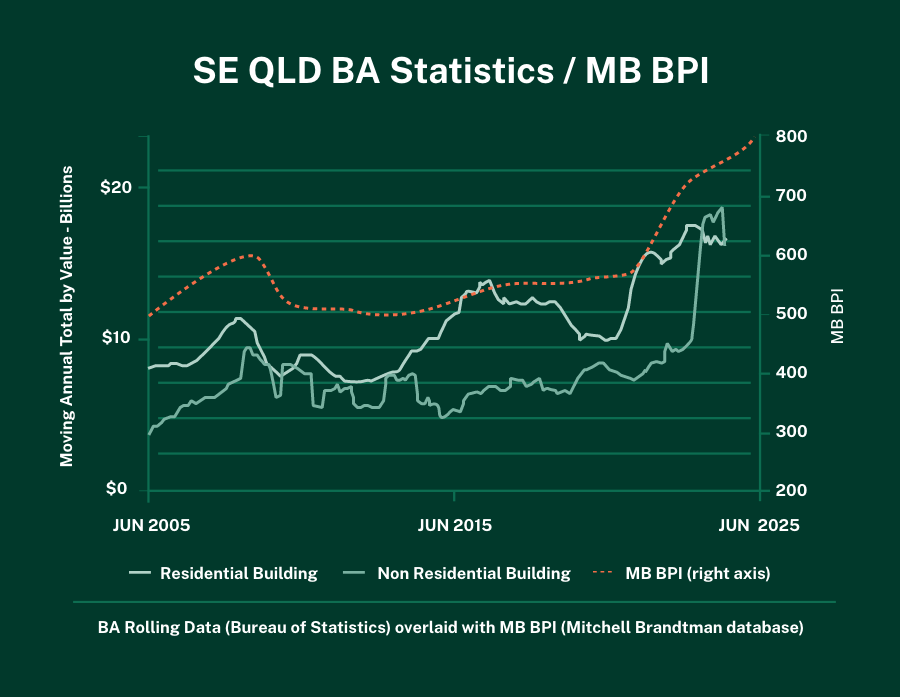

Market Trends & Future Outlook: Clients gained insights into current trends and future expectations for building approvals, labour, and material costs, essential for forward planning.

Risk Management in Procurement: Tass highlighted the importance of prioritising strong risk management practices to mitigate potential project risks.

Thank you to all who attended and contributed to the success of this insightful event!

Mitchell Brandtman has you covered…

Now is the time to start thinking about your projects and in particular your obligations prior to Christmas 2024 and your plans for the New Year.

One of the most critical obligations to plan for leading into Christmas are Progress Claims/Payments, so we have put in place a target date of Wednesday 11th December 2024 being the last day for all site inspections and all progress claim information. This will ensure all reports are completed and issued prior to Christmas shutdown which is the 21st of December 2024 to the 5th of January 2025.

Remember to also discuss timing dates for payments with the rest of your project team and specifically, your Financier to ensure obligations can be met through this period.

Looking at commencing construction early in the New Year? To ensure we can cater for your project’s pre-funding requirements, we have set a target date of Monday 2nd of December 2024 to receive all required information for Pre-Funding Initial Reports. This will ensure that any new Initial Reports are issued prior to the Christmas shutdown and will help you hit the ground running in 2025.

We understand that it is not always possible to predict when a report or assessment will need to be done. So, if you have any concerns, please do not hesitate to give us a call, right up until 11am Friday, 20th of December 2024 and we will be happy to talk through how we can help.

Please contact our team at MB to book your Pre-Christmas inspections / reports.

Our office will be closed from 21st of December 2024 and will re-open on Monday, the 6th of January 2025.

We hope you have a very Merry Christmas and a safe and happy holiday.

Participation in our Melbourne Cup 2024 Sweeps is by invitation only!

As a thank you for your continued support and business, we extend to you our sweeps for a chance to win a gift voucher!

Best of luck to all who enter!

Please check your email inbox for details and terms and conditions for entering the sweeps.

This Mitchell Brandtman Quarterly Construction Cost Update

has been put together to help keep you informed on the

movements of the market to better position yourself for your

current and future projects.

For more information, please contact Colin Prince: cprince@mitbrand.com

A Tax Depreciation Schedule by Mitchell Brandtman is a risk-free and valuable tool for any property owner. We provide tax depreciation advice and Australian Taxation Office (ATO) compliant depreciation schedules that help property owners invest more wisely and build wealth.

On 30th of May, 2024, Mitchell Brandtman hosted a client party to thank our clients and contacts at the QT Rooftop in Melbourne.

What a great night!

We thank you for your continued support and look forward to working with you all into the future.

This Mitchell Brandtman Quarterly Construction Cost Update

has been put together to help keep you informed on the

movements of the market to better position yourself for your

current and future projects.

For more information, please contact Michael Ehmer: mehmer@mitbrand.com

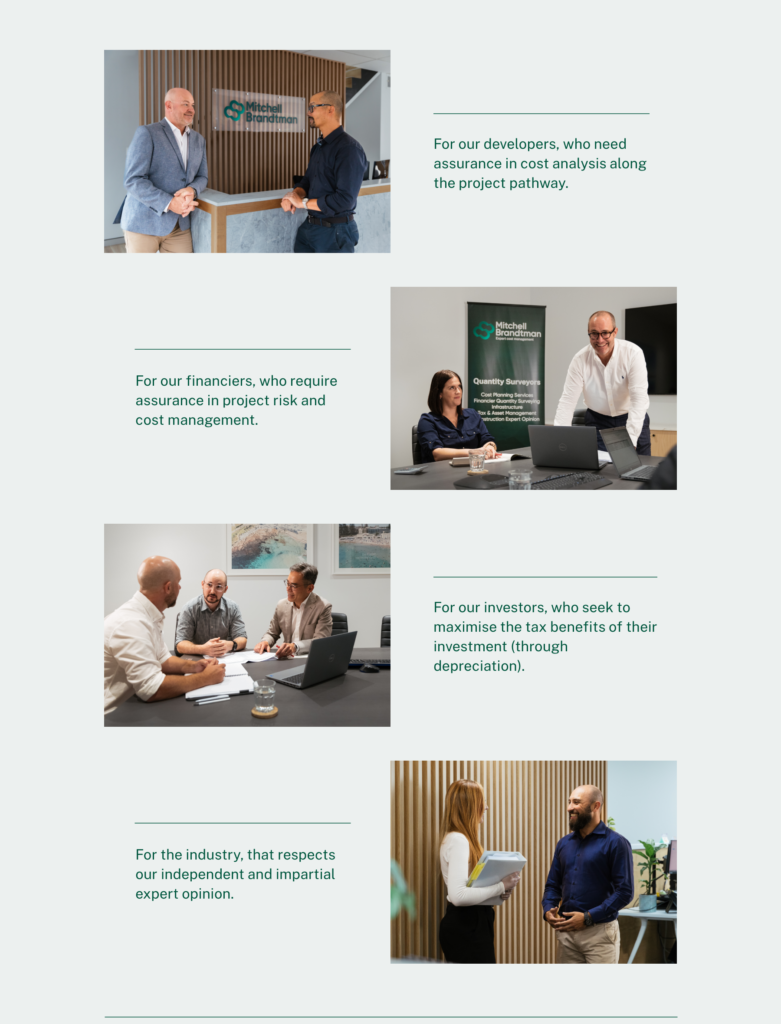

In 2023 Mitchell Brandtman began the process of refreshing it’s brand. Through extensive research gathered to provide insights about our brand – how our clients see us, and how we see ourselves – we discovered our true purpose, position, unique selling proposition, and brand story.

What this process uncovered is that at its core, Mitchell Brandtman is about enabling success for all of its stakeholders: