Author: manager

Last week, BIM advocates across Queensland rejoiced upon receiving the news that the Queensland Government had formally put its position out to industry on BIM by releasing the paper on Digital Enablement for Queensland Infrastructure, Principles for BIM Implementation.http://www.dsdmip.qld.gov.au/r…

We’ve BIM Waiting…Part 2

Last week, BIM advocates across Queensland rejoiced upon receiving the news that the Queensland Government had formally put its position out to industry on BIM by releasing the paper on Digital Enablement for Queensland Infrastructure, Principles for BIM Implementation.

http://www.dsdmip.qld.gov.au/r…

It’s been a long time coming. Our company, Mitchell Brandtman has persisted and helped drive the BIM conversation globally for over 10 years now and our 5D Cost Planning team has been forging ahead in the quantity, cost and time space.

For someone who is passionate about influencing positive change to benefit us all, it’s great to know that the Queensland Government has officially recognised the opportunities and benefits than BIM can provide.

…we are so ready for this!

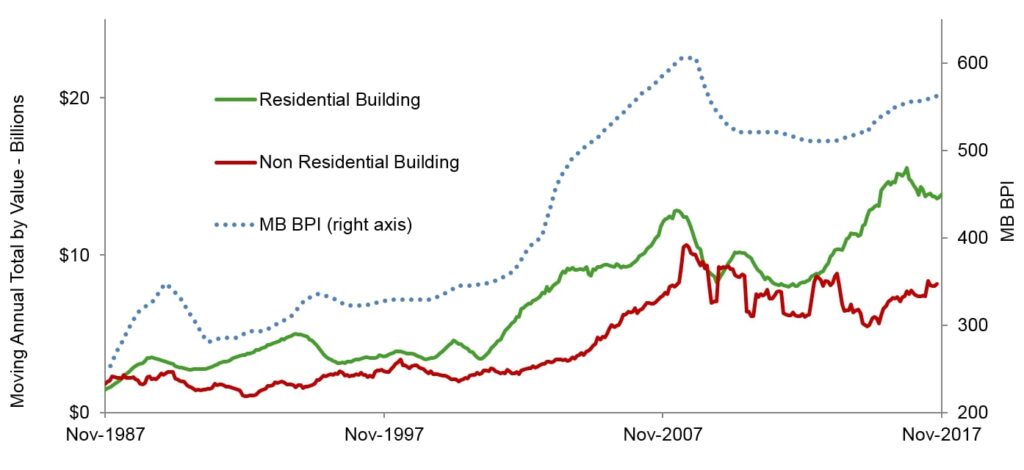

Will increased infrastructure spending offset the drop in residential approvals, and what will be the impact on residential construction costs over the next 12 months? Mitchell Brandtman explore the current residential construction cost market for 2018.

National Escalation Forecast

National Commentary

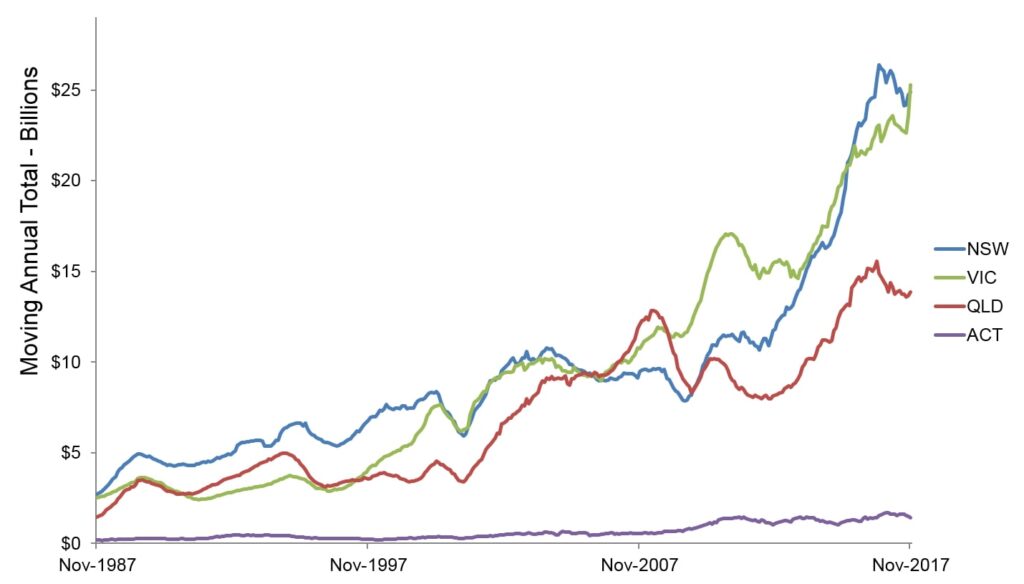

Residential Building Approvals

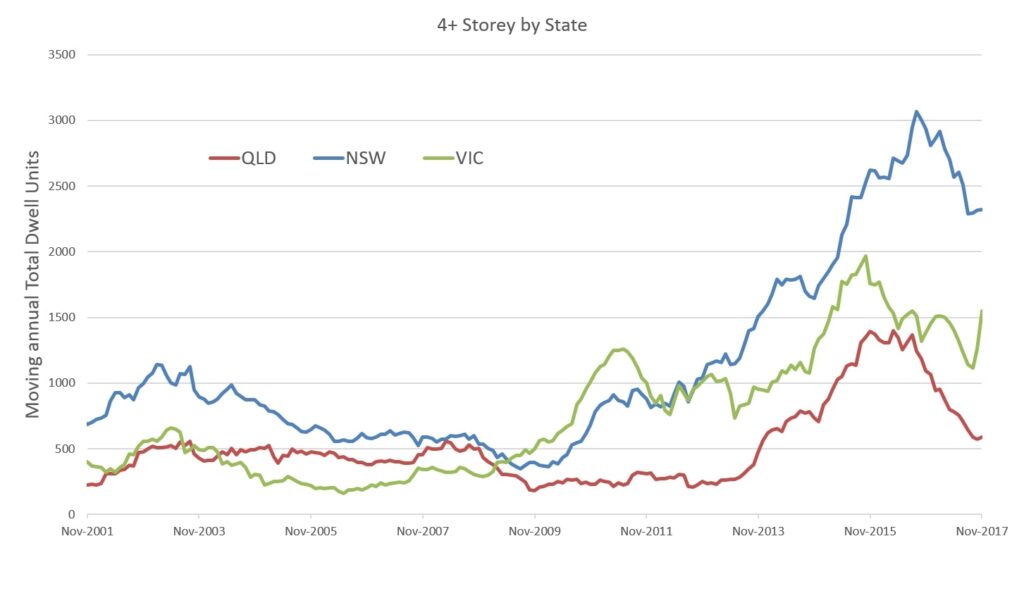

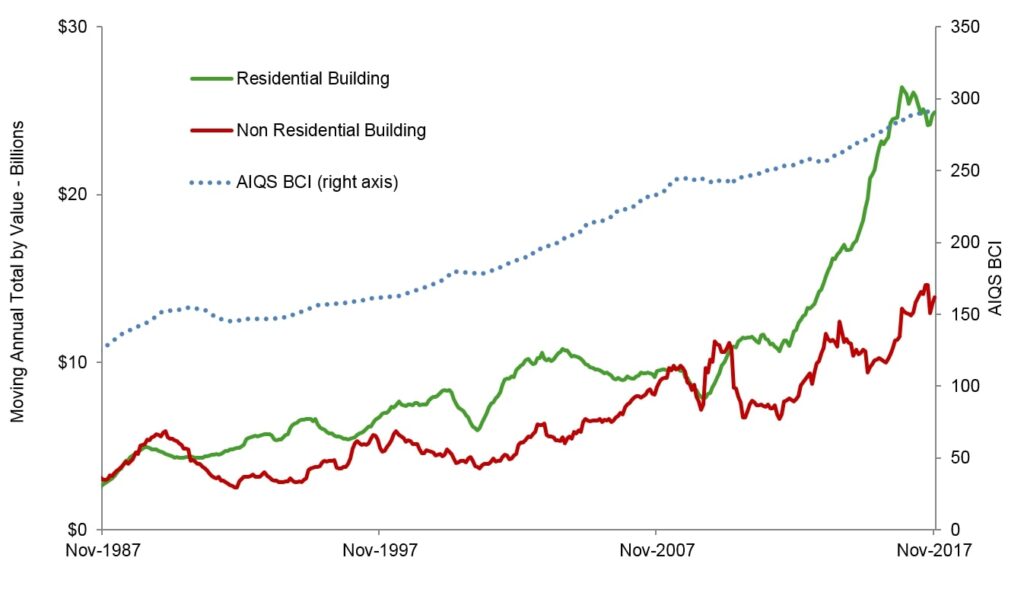

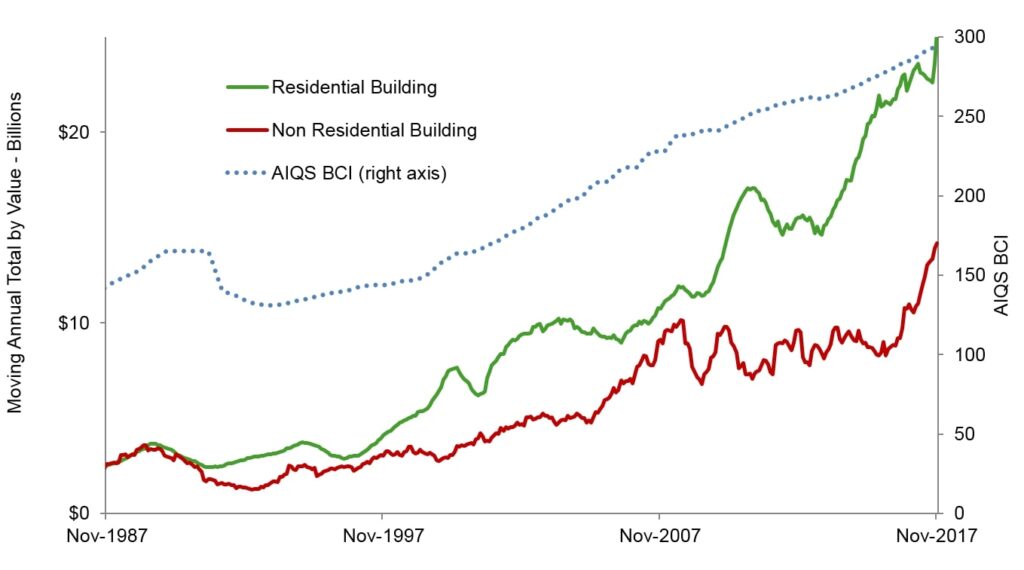

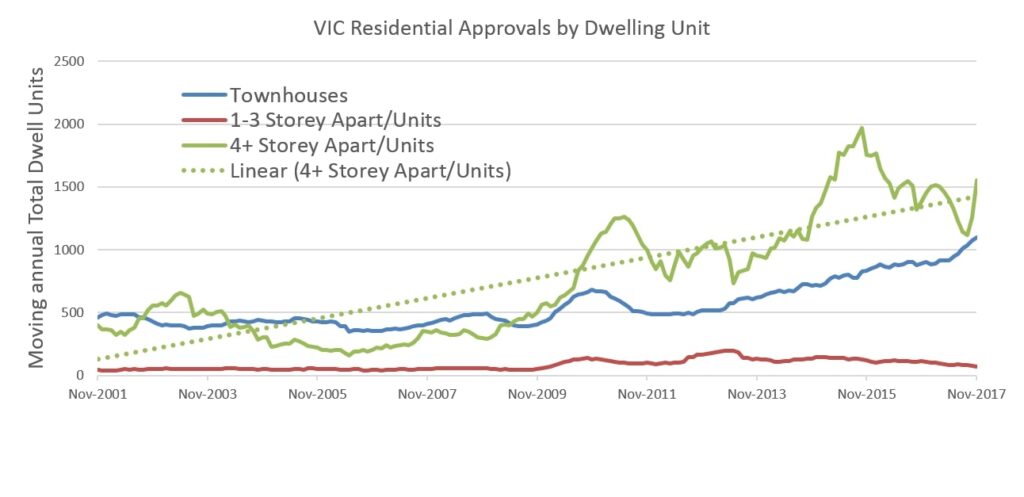

Regardless of where individual States sit, overall residential building approvals on the East Coast remain well above their long term averages. However the heat is starting to come out of the market and this is slowly starting to translate itself into reduced activity and confidence in some areas. When we look at approvals on a moving annual basis, we can identify that approvals for developments with more than 4+ Stories have been trending downwards for the last 12 months. While Victoria has bucked the trend with an upswing in residential approvals, the general feel is that national residential approvals will be off the previous high but still remain strong.

The following graphs highlight the turnaround in residential approvals across the East Coast. The market was being dominated by a proliferation of high density unit developments, however the focus on these developments took away the limelight from a strong growth in Townhouse developments. This sector, with the exception of QLD, still hasn’t found its peak and appetite remains strong.

It is worth noting we have seen a re-imagining of townhouse product to attract owner occupiers. There is increasing popularity of larger townhouses with 3-4 bedrooms and ample living and storage space. This change correlates to a changing product mix and target market for larger unit developments which had an impact on cost per unit over the last 2 years. Interestingly this change hasn’t yet followed through to smaller unit developments (3 storey walk-up product). It appears that this market is not at a stage where the increase in amenity would be reflected in increased sale prices. Developers that are seeing success at the moment are moving away from investors (particularly offshore) and embracing owner-occupiers, particularly in the more affordable middle to outer ring suburbs.

QLD Commentary

QLD Building Approvals

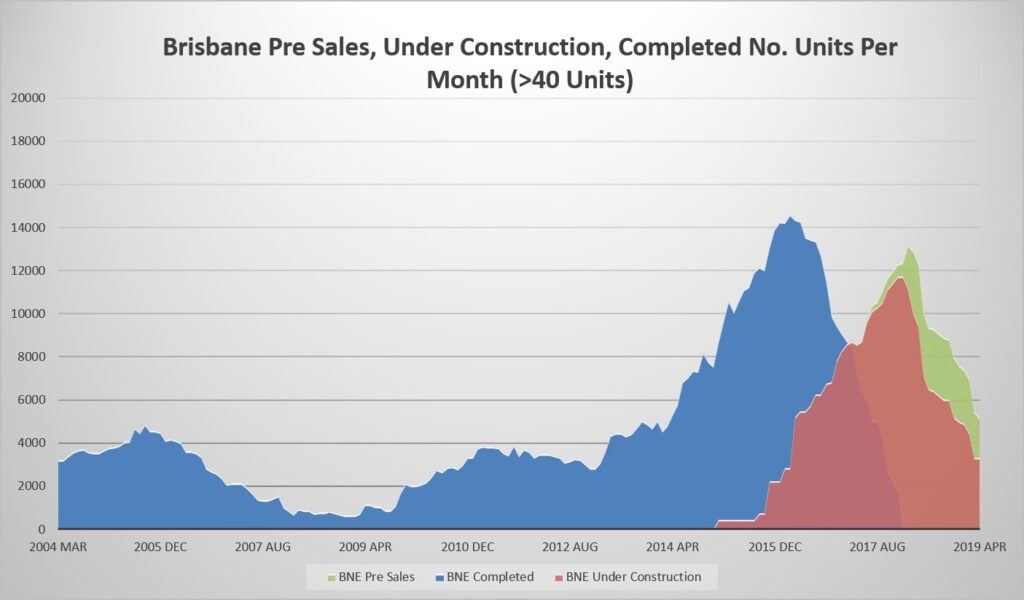

Drilling into South-East QLD and Brisbane in particular, we are seeing both residential approvals and residential construction down off peak numbers, however this needs to be taken in context. We are still currently constructing nearly twice the amount of our pre-GFC high. Major projects such as Queens Wharf, and the Howard Smith Wharves, alongside an increase in infrastructure projects continue to provide a buffer for contractors. However, despite the significant size of some of these projects, activity in these other sectors is not expected to counteract the slowing in activity overall and subsequent declining pressure on construction costs.

We do not expect residential construction costs to drop off dramatically at the head contract level, although there may be some opportunity to recoup margin at the sub-contract level.

Despite rumours to the contrary, Finance is obtainable for projects that stack up, however we are increasingly seeing experienced developers taping into alternate funders. The Big-4 banks are struggling with APRA and Basel Accords, and how this plays out on lending criteria and flows through to impact areas such as pre-sales and resistance to off-shore (and even interstate) buyers. Developers, while initially reluctant to pay a premium, are now becoming comfortable with the alternate lending offering and flexibility it offers.

NSW Commentary

NSW Building Approvals

NSW continues to go from strength to strength, across multiple sectors. Residential construction, infrastructure, commercial, and office all remain strong. While headline focus remains on roads and rail and the opening of new commercial hubs in the CBD, there is strength throughout the sectors.

Significant development opportunities still exist around both the new Western Sydney airport and Norwest rail link (due to open at the end of 2019). There will be significant amounts of stock coming online in these areas.

This is placing considerable pressure on both labour rates and trade availability. In particular finishing trades and formwork. There is no sign that this will ease in the near future and may be negatively impacted as infrastructure projects move into their build phases.

Regions such as the Illawarra and Hunter continue to thrive off the back of both the growth in the Sydney market and increases in local amenity. Supply of residential apartments and subdivisions in these areas is growing in line with demand. Some units in these areas are starting to find their price ceiling and the challenge going forward will be keeping product affordable.

VIC Commentary

VIC Building Approvals

Infrastructure continues to compete for the limelight with the residential sector in an already buoyant Victorian construction market. Resi approvals kicked again, and it is interesting to look closer at the detail. Headline articles have painted larger apartment projects as in decline. While these have been lumpy, the medium term trend remains positive and any short term losses were partly being offset by strong gains in the townhouse sector. The recent kick in 4+ Storey Units may not be sustainable given that it is heavily influence by a small number of large projects being bought to market.

While there remains wage growth pressure, the slight shift from large scale unionised projects to mid-rise residential and civil projects is having a dampening effect, as is the slow release of non-residential projects.

Representatives from our 5D Quantity Surveying team were invited to present at this year’s BILT ANZ 2017 in Adelaide. With over 380 delegates in attendance and a huge array of quality speakers, it was great to again be part of such a collaborative conference.

BILT is an annual event, run in multiple regions around the globe, designed to cater to the needs of those who design, build, operate and maintain our built environment. As a community of professionals, it is dedicated to improving the way industry works together.

As an educational and networking event, BILT provides a variety of opportunities to learn and share, to probe and challenge, to listen and to be heard. The sessions focused on the use of best-in-class tools, processes and workflows, behaviours and leadership.

2017 was an important year as the conference incorporated an ‘Estimation Stream’ to bring estimators and Quantity Surveyors into the conference. It was exciting to share our knowledge of both 5D and 4D Quantity Surveying and to be immersed in conversations around technology and where the QS profession is heading. It was really humbling to hear across many forums, that Mitchell Brandtman are know as the cutting edge QS firm that educate and encourage other QS’s to upskill in the use of these technology tools.

Scott Beazley, Digital Technologies Manager / Resident Celebrity, presented two, 75 minute presentations on ‘Modelling for 5D’ and ‘IFC used in Anger’. They were both very well received and spurred great conversations.

Natalie Chaves, 5D Quantity Surveyor and Caitlin Shields, 5D Quantity Surveyor and Associate, presented ‘ Virtual Construction Management’ , which spoke through the workflows of a QS at Design/ Tender and Construction Stages. With many great questions from the floor, this lead to discussions flowing into the break.

Mitchell Brandtman are very proud of the investment we have made for over 10+ years in the use of technology in our industry and how we can share this with our colleagues.

We would like to thank the organises of BILT ANZ 2017 for hosting such a great conference, the sponsors and the many speakers who all shared their time and knowledge. A special thank you to Peter Clack, AIQS President who attended the the BILT conference, offering a message to our peers and consultant friends that the AIQS is getting serious about the importance of technology and its use in our industry.

We all walked away buzzing with excitement as to what the future holds, our involvement and the new friendships formed with like minded colleagues.

Thank you from the Mitchell Brandtman Melbourne Team

Each year in April, Mitchell Brandtman Melbourne enjoy hosting a VIP event to thank our clients for their continued support.

Mitchell Brandtman would like to thank all of our Property Industry friends for sharing in a great night at Mon Bijou Melbourne. It was a night to thank you and an opportunity to catch up face to face, network and socialise on a balmy Melbourne evening.

It was a fabulous night and it is great to know that our clients appreciated Mitchell Brandtman hosting this event also,

‘Thank you for a fabulous evening. It was great to have the opportunity to meet some of your colleagues and clients. The venue was fantastic and the Mitchell Brandtman hospitality was incredibly generous. Thank you once again and I look forward to catching up in the future.’

‘Thank you for a wonderful night yesterday. Your company was extremely generous to host such a function and the venue was fantastic.’

We look forward to seeing you all again next year.

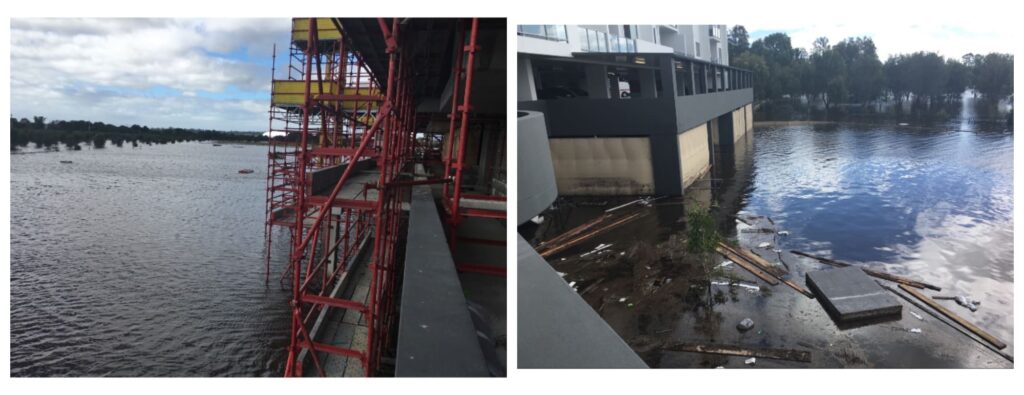

Mitchell Brandtman’s thoughts go out to everyone impacted by Cyclone Debbie and the resultant deluge that hit South East QLD and Northern NSW yesterday. Our team have been on the ground this morning assessing the impact to our sites and are in the process of contacting clients to offer any assistance.

For those that can’t get out to sites, a general update and some feedback from site:

– So far the majority of sites that were out of the ground have only suffered minor storm damage and water ingress and will dry out over the weekend however there are numerous sites across the South East with flooded basements and excavations

– Only a small number of sites are reporting significant damage

– The Gold Coast has been hardest hit so far with site flooding – some units are viewing water a lot closer than planned

– Subbies are back onsite at approx. 75% of sites

– Most cranes in Brisbane are not working today due to wind

– Multiple reports of site and safety barriers blown over and in the process of being repaired

– Scaffolding teams have been working since midnight fixing loose scaffolding and inspecting bases positioned on water-logged ground

– Pumps and tankers are in demand and are working away at numerous sites

– Developers and Contractors are all dusting off their contracts and reading the fine print on rain (and the effects of rain) delays

– We are hearing 2-10 days clean up time in general, however the worst impacted sites could be significantly longer

– There has been a change in recent years for Contractors on larger projects to take on the risk of all rain delays – check your contract

– Generally Developers will wear the time delay and contractors the cost of the clean-up, however the extent and definitions will vary between contracts

– Contractors are generally still entitled to be paid for work completed but damaged in the storm – insurance may be available to offset the impact to the contractor of repairing the damage but the impacts of this are outside of the contract progress claim process

– Civil contractors are busy calculating the damage and maybe be considering if self-insuring was the way to go

– Body Corporates are busy marking up water leaks and are already on the phone to builders’ maintenance teams – this the biggest rain event that many newly constructed buildings have experienced

– Contractors that were already under stress didn’t need this

Stay dry and if you have any questions don’t hesitate to call one of the team 1800 808 289. Here are a few photos of our sites today.

As current market tenders become more competitive and harder to win, developers and contractors are looking toward innovative technology in order to streamline the entire tender process. In today’s Urban Developer, Matt Hemming Partner, Mitchell Brandtman, shares his knowledge on this topic.

Technology such as Building Information Modelling (BIM) – especially 5D and 4D BIM – allows developers insight into project time, cost and quality. All elements that can be the critical difference between delivering a project on time and on budget.

In the tender phase, a developer can utilise BIM technology to provide contractors and subcontractors with 3D design models that help them understand the project and create a more accurate, reliable, cost-effective and certain tender.

Accuracy

Since BIM’s deliver a digital representation of the physical and functional characteristics of a project, the accuracy this technology provides is almost second to none.

With a digital representation of the project, the high level of detail allows contractors and subcontractors to accurately estimate the elements of the project to deliver tenders that will be true to the realities of the build – making for a highly competitive market tender.

In February 2017, the Queensland Government released the Building Information Modelling – draft policy and principles for Queensland with a request to read and provide feedback here.

This is a long awaited step forward taken by the Queensland Government. Mitchell Brandtman wholeheartedly supports this initiative and what it can mean for the Queensland development and infrastructure landscape.

In reading through the draft it is clear that the Queensland Government has a positive purpose for the implementation of BIM and understands the potential for their future assets and for the industry as a whole.

With Mitchell Brandtman being BIM advocates for well over a decade now, this initiative is encouraged and celebrated and we cannot help but to reflect on the journey that Queensland has travelled to get to this point.

Prior to 2013, the Queensland Government’s professional design and building department, Project Services, was actively engaging in BIM discovery and implementation in close consultation with the private sector. On the Quantity Surveying front, a small working group was established made up of public and private sector, including Mitchell Brandtman, and was meeting regularly to brainstorm collaboration platforms, frameworks and protocols for projects. With the Queensland Government leading by example in BIM development at that time, good headway was made which encouraged the private sector, in at least the QS space, to engage more with BIM and the various disciplines it involves. We also expected a document such as this would come sooner given the momentum at that time, which further pushed industry to listen closely.

This momentum came to a grinding halt late 2012 with the then new Government redeploying many government jobs including within the Project Services department.

But the private sector carried on, pushing the boundaries of BIM and collaboration further, overcoming many of the teething problems of a new workflow in a very staunch industry. So Government is well positioned to now leverage off this progress both locally and internationally, by this re-engagement with the private sector. We are ready, well most of us are… after all, nothing drives change like a looming mandate.

We note that buildingSMART have publically released their draft response to the document here.

Reading through their response, we entirely agree with their recommendations.

This is a great initiative, which Mitchell Brandtman supports entirely. We are working on a formal response to the Queensland Government and encourage any discipline that advocates positive change to have their say too.

Be sure to join us at this Urban Developer event across QLD, NSW and VIC, whereby the Partners of Mitchell Brandtman, in association with Development Finance Partners and Hall Chadwick will provide an in-depth look into Navigating The Funding Maze: What Developers Can Expect From Bank and Non-Bank Lenders in 2017.

As Australia’s development sector moves through an unprecedented construction boom, the availability of property and construction credit has contracted.

The void left by traditional sources of development finance, such as the major banks, is being partly filled by non-traditional financiers, such as private lenders, pension funds and non-bank commercial lenders.

But what does this all mean for developers and investors, big and small?

How can property developers ensure that their projects are successfully funded in this next cycle?Event attendees can expect to hear opinions and insights into:

- What can developers and investors expect from bank and non-bank credit providers in 2017?

- What are the major challenges facing the availability, terms and cost of project finance?

- What strategies can developers and investors employ to ensure success?

- What new sources of funding exist in the market place and what are their terms?

- What tax strategies can developers and investors employ to optimise?

- How are construction costs and contract terms impacting financier’s appetite for lending?

Who should attend the event?

- Residential, commercial and retail developers

- Residential, commercial and retail investors

- Banks, brokers and financial institutions

- Real estate agents and marketers

- Planning and government authorities

- Architects and design professionals

- Engineering and construction providers

Click to Register for this Event

The speakers from the Team at Mitchell Brandtman include:

Maoibh Russell, Partner / Mitchell Brandtman

Maoibh is a Partner with Mitchell Brandtman and is a Manager of the Financiers’ Quantity Surveying Team in QLD. With over twenty-two years’ experience, Maoibh’s market intelligence and knowledge of the industry has seen her invited to speak at various conferences and industry forums both here in Australia and across the globe.

Maoibh offers a solid basis of expertise in all areas of construction and development, particularly for projects in the residential, commercial, infrastructure and industrial sectors and is currently the lead QS advisor for the public realm component of the $3 Billion Queens Wharf project.

Andrew Opperman, Partner / Mitchell Brandtman

Andrew is a Partner with Mitchell Brandtman and a Director of the Financiers’ Quantity Surveying Team and Asset Management Team in NSW. With over 12 years’ experience, Andrew has worked on a variety of diverse projects from residential, commercial, industrial, aged care and hotels, to name a few.

After completing a degree in Bachelor Economics, Human Resource Management, Andrew decided the Property Industry was his passion and then completed a degree in Bachelor Building Construction Economics.

Andrew has been with Mitchell Brandtman for over 10 years and his key roles include the preparation of Finance Reports, Cost Planning, Estimating, Post Contract work and Expenditure Control. Andrew has also been involved in numerous expert witness and securities of payment claims and has a vast experience in all types of projects in the construction industry.

Darryl Bird, Partner / Mitchell Brandtman

Darryl is a Partner with Mitchell Brandtman and is the National Manager of the Financiers’ Quantity Surveying Team. With over twenty-three years’ experience, major banks and developers have come to depend on Darryl’s expertise in identifying and managing construction risk.

His expertise is in the area of financial due diligence, drawdowns and construction contract administration services. Darryl is regularly invited to share his knowledge at industry events and workshops both throughout QLD and interstate.

Darryl has a reputation for a highly professional results-driven approach and has led project teams on some of the firm’s largest and most challenging construction projects.

Access to development funding is an integral part of the property development process given the industry is so capital intensive. Capital has become harder to secure since the global financial crisis and in more recent times an unprecedented construction boom. Now more than ever it’s become important for developers to have a clear understanding on how to secure funding and satisfy the requirements of lenders

With the contributions of Michael Ivey, C.E.O and partner at Mitchell Brandtman and Matthew Royal, co-founder of Development Finance Partners; The Urban Developer has investigated five key tips for securing development funding.

1. Communicate Early And Do Your Due Diligence

Before a you secure funding for your next property development, it’s key to communicate with your financier and their preferred quantity surveyor (QS) to ensure that your bank or lender has comfort over the building team, construction and other costs and the agreement between the parties.

“It’s about looking at the proposed development to identify potential areas of risk including consideration of the risk mitigation strategies in place to inform the potential financier. With this in mind, it makes sense to instigate early engagement between your financier and the QS to ensure the development structure, team and contract platforms align with that supported by potential Financiers. Such engagement should provide the most efficient outcome from a cost and time perspective,” says Ivey.

The Due Diligence process will also increase your credibility with financiers and position you as less of a risk in your lender’s’ eyes.

“For the development program to be valuable, it must be evidence-, valuation- and QS-based and supported. Through obtaining valuer and QS support the key assumptions of your feasibility and cashflow become more bankable in the future, which greatly reduces your financing risks later,” says Royal.

2. Have A Clear Understanding Of Both Your Financier’s And Your Own Finances

Understanding the capabilities of those who’ll be financing your development is equally as important as understanding your own financial capabilities. Know where you’re money is coming from and how it is placed within the marketplace.

“Financiers appetite for funding moves in waves and are influenced by factors outside of just your deal. If a financier is ‘overweight’ in a particular sector, location, product type, or with a particular contractor – you may not get funding, no matter how solid your project is. This appetite will invariably be different for different financiers at different times. Certain banks are not lending for residential, but if you have an income producing investment style asset such as a child-care, or retail project or similar your funding options may be broader,” says Ivey.

Whilst it is critically important to assess the lending potential and circumstances of your financier, you cannot hide your own personal circumstances.

“It is obviously at this point that you should be working closely with your financial advisor or banker to understand how you are going to finance the entirety of the development from beginning to end relative to personal financial capacity,” says Royal.

3. Get Your Numbers Right

aving a clear understanding of your project budget and how you’re going to spend both your and your financier’s money is imperative to mitigating risk. Ivey says there are four key tips to executing this;

The most effective project savings are usually achieved early in the design phase when changes cost less to implement. Early feedback on construction costs, design options, and value management are critical.

Ensure you prepare a diligent, holistic budget which addresses all facets of the development. Whilst the developers ability to fund equity contributions and/or particular elements of the development is normal, financiers are focussed on a deeper understanding of where the developer’s funds are being spent across the broader cost centres.

Your budget should highlight areas often missed or not clearly identified. For example, works outside the boundary, utility connection fees and specialist consultants fees.

Banks are looking closely at feasibilities and in recognition of the low margin environment are looking in particular at contingency. You need to know what that means for you and your project – talk to your QS.

4. Coordinate With Care; The Team You Build Can Either Win Or Lose You The Game

Consulting with the right professionals will inevitably contribute a large part to the success of a development. Selecting who you choose to consult with, in particular your Contractor is a process that requires careful consideration.

“Despite the opinion of many in what has appeared to be a development boom, the contracting game has not been an overly profitable one for most. Whilst typically not the only reason, the low margin environment most contractors have operated in for some time now has contributed to a recent and ongoing list of contractors who are struggling, or worse failing, and consequently the banks are watching this space extremely closely. So the “right” contractor may win or lose you a preferred funding deal,” says Ivey.

Which may present a particularly challenging issue for developers as there are only a limited number of preferred contractors.

“As preferred contractors in good standing with the banks become harder to find, developers are resorting to locking them in earlier by using early engagement models such as Design and Construct (D&C) contracts. These of course come with their own challenges but when set up well can provide the required outcome in a challenging market.”

According to Ivey, it is important to remember that contractors must run a profitable business to provide a successful development outcome, so squeezing margin from contractors just to make your project feasibility viable is not necessarily the right approach.

‘Always leave a bit on the table for the next guy,” he says.

Selecting the right contractor is a much more efficient process with the advice and assistance of a good development manager.

“It is at this point where you begin to realise the extent of ‘what you don’t know’ and can appreciate the value of the advice and guidance that an experienced development manager can provide you with.

A development manager can assist you to build a ‘Development Program’. A sound development program is the fundamental core to any successful development company especially where there are heightened elements of complexity. Other key team members you’ll need to consider are; a specialist property finance advisor, a town planner and a property solicitor,” says Royal.

5. Have Your Information Ready

Financiers can appear to be asking for a lot of information, however if utilised efficiently this part of the process can be vital for double checking the facts. They provide the opportunity for a second set of eyes looking over your project via the financiers QS and valuer.

“The list of information requested by the QS may look daunting but by preparing early and assisting the QS in obtaining and understanding the information the outcome becomes a value added service. Typically it will take up to 10 days from receipt of all information to understand and analyse, so if time is of the essence then plan ahead,” says Ivey.