Enhance the value of your investment and put more money in your pocket when you receive your tax return.

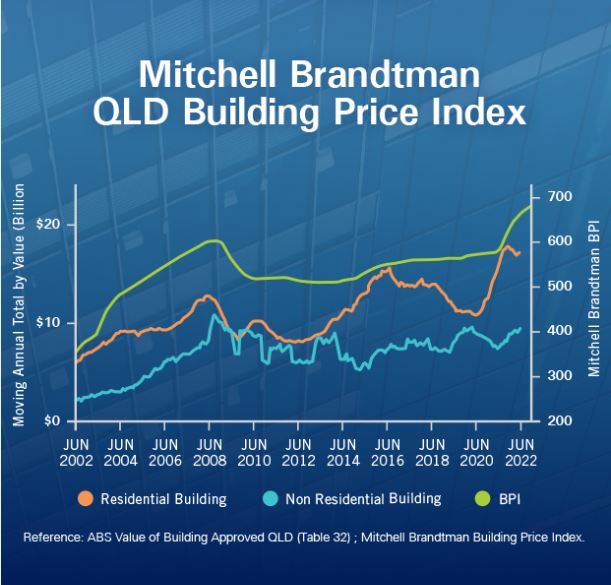

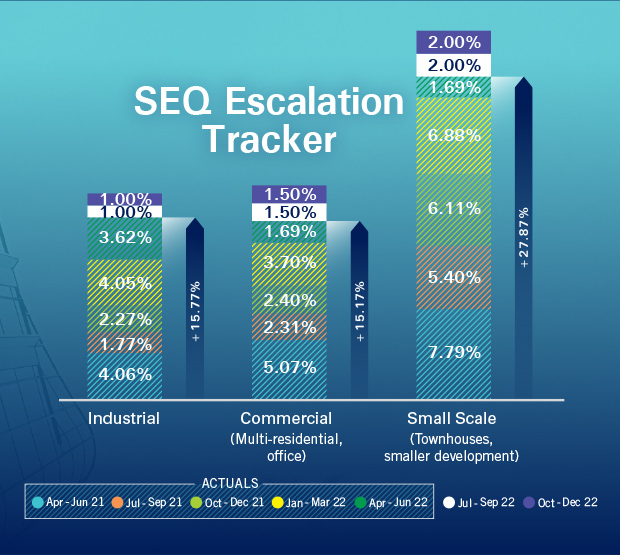

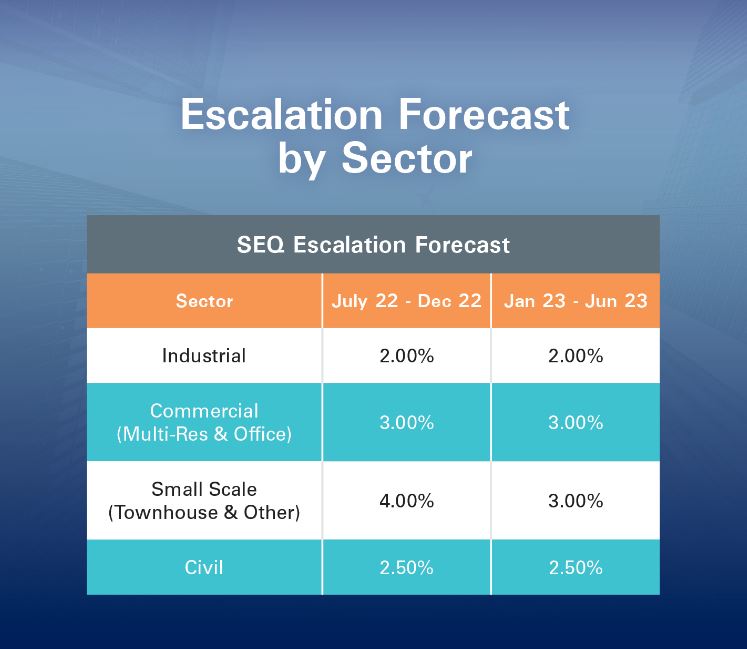

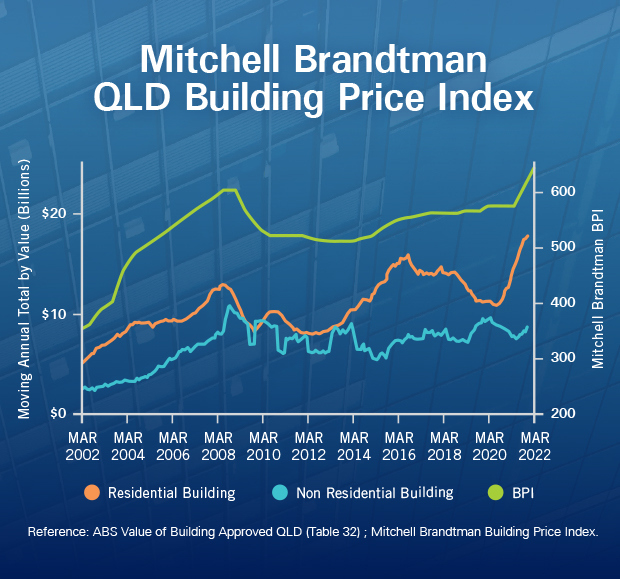

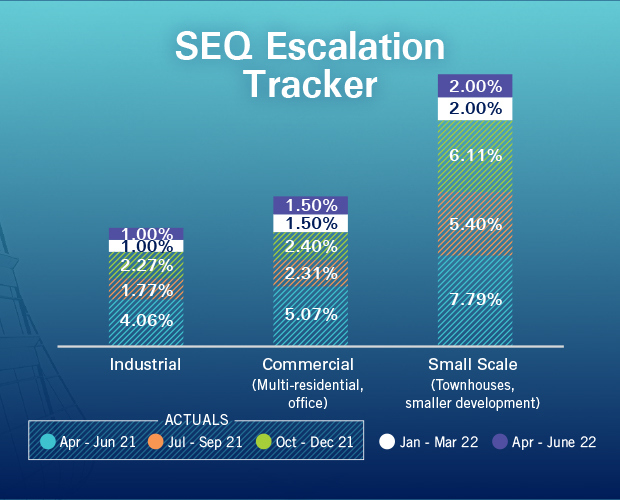

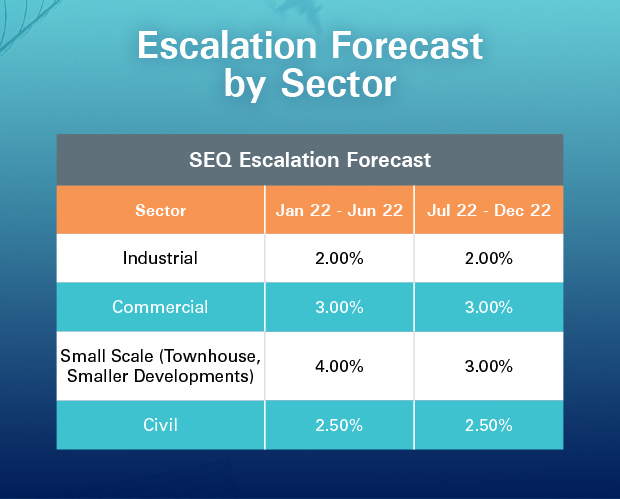

With the amount of real cost escalation SEQ has experienced over the last 18 months, project feasibilities are not surprisingly becoming challenged as we watch the dynamic between supply and demand continue to be troublesome.

The Mitchell Brandtman Quarterly Construction Cost Update has been put together to help keep you informed on the movements of the market to better position yourself for your current and future projects.

Over several days, Urbanity brings together industry leaders from across the Asia Pacific to deliver an inspired program of learning and connection. Urbanity is a must-attend event for anyone that is involved in urban development.

Important to note:

The recent significant flooding event across SEQ and Northern NSW is expected to put additional strain on an already volatile market.

The following data is for information only and is based on analysis of typical market projects undertaken across the sector. This generally excludes large scale, one off type developments and infrastructure related projects.

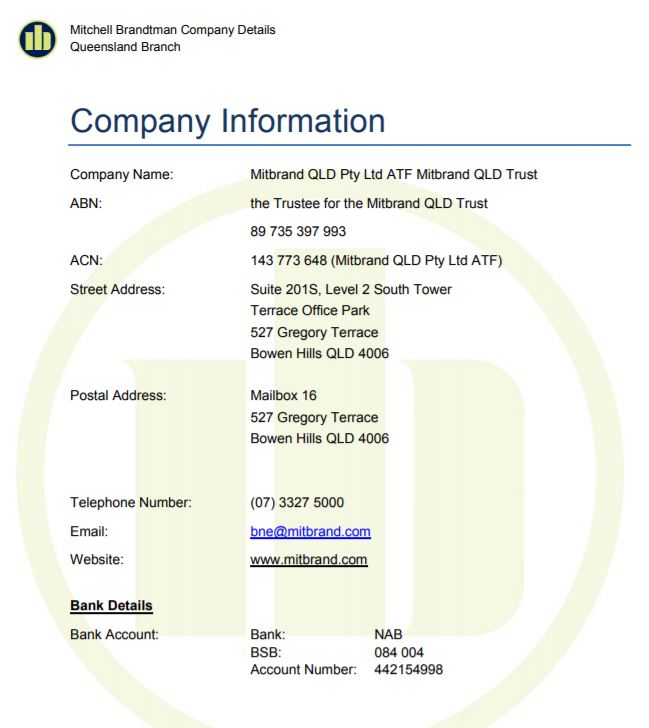

As of 1 July 2021 our trading entity will change from Est Chasley 1970 Pty Ltd as trustee for the Chasley Trust to Mitbrand QLD Pty Ltd (ACN 143 773 648) ATF Mitbrand QLD Trust.

This change will bring us in line with our teams in other States and also pave the way for the next generation of leaders within our firm.

All active projects will be novated to the new firm and Mitbrand QLD will also be collecting all outstanding accounts on behalf of Chasley Trust. Please take this opportunity to update our new ABN and banking details in your system.

Every builder I speak to is always nice and willing to offer their opinions on costs and build rates, and some will even provide a proper estimate – if it means getting a foot in the door. So why not tap into this seemingly free service? Well as a passionate cost advocate and Quantity Surveyor, with a deep respect for Contractors and the fine art of building, here’s 5 of my top reasons why a builder shouldn’t set your budgets:

1. Builders are not Quantity Surveyors. Builders are masters in the art of managing construction. Quantity Surveyors are cost masters. We literally think about, and work with building costs all day, every day.

2. Builders intimately know the projects they build. Quantity Surveyors are involved in hundreds or thousands of projects and have access to structured cost information and benchmarking data across an entire market.

3. All builders are different and provide advice relative to their specific situation. Quantity Surveyors only provide independent, unbiased advice without a commercial interest.

4. Builders have great estimating teams that are designed to nail a tender opportunity. Quantity Surveyors undertake estimates as one part of a holistic cost management role.

5. Builders want to focus on what they are good at, not solve someone’s development budget equation. Quantity Surveyors eat budget equations for breakfast.

Use Mitchell Brandtman’s experience and technology to get ahead of your competitors and keep your clients happy.

Our highly agile and reliable team will work with you to deliver your trade packages and quantify changes to free up your internal resources for getting new revenue streams.

Get in touch with us to discuss!

Tass heads up Mitchell Brandtman’s Sydney CBD office which provides traditional cost planning & cost engineering services, specialist Financier Quantity Surveying and Asset Management / tax depreciation services.

Starting as a cadet with Mitchell Brandtman, Tass has been a part of the team for over 12 years. He has a diverse range of experience in both the NSW and VIC markets, and opened the MB Melbourne office in 2014. Clients have relied on Tass’s expertise across a broad range of areas including residential, commercial, hospitality, accommodation, mixed-use, civil and health projects.

Our firm is built on people and relationships. Tass embodies these ideals and will continue to be instrumental in leading the business, working with our clients, mentoring team members, and sharing his knowledge on a day to day basis.

Contact Tass – Tass Assarapin 0403 104 042

Whilst this situation is obviously not ideal for a landlord, in today’s uncertain economic climate there are opportunities available. Landlords may inherit the tenants abandoned Division 43 Capital Allowances. This can result in significant tax deductions for the landlord.

What Is Tenant Abandonment?

Tenant abandonment occurs when a tenant vacates the premises either at the end of the lease or at any other time prior and does not make good the premises in accordance with the lease.

All items of tenant’s installations and tenant’s property will be considered abandoned and will become the property of the landlord.

In this situation the ownership of the Capital Works, Division 43, component of the tenants fit-out reverts to the landlord, who can continue to claim the balance of the Division 43 allowances based on an annual claim of 2.5% of the original construction cost. Alternatively the landlord can claim the remaining value as a balancing adjustment should they carry partial or full demolition of the fit-out in order to entice a new tenant to take up the vacant space.

Example A tenant incurs a capital cost of $300,000 to install a fit-out within a commercial/retail property. The Division 43 components of the fit-out primarily consist of:

The value (based on construction cost) of these Division 43 components is approximately $180,000 or 60% of the capital cost incurred by the tenant. (It should be noted that the landlord generally cannot claim deductions for the balance of the capital cost relating to Division 40 components such as workstations, furniture and fittings etc.) After three years the tenant relinquishes their lease and vacates the premises abandoning the fit-out. The beneficial ownership of the fit-out reverts to the landlord. The landlord has two primary options available to them.

Option 1 – Lease out the premises with the fit-out intact to a new tenant The landlord can continue to claim the inherited Division 43 deductions at the rate $180,000 x 2.5% or $4,500 per annum.

Option 2 – Demolish the fit-out to meet the requirements of the market or a new tenant. The landlord can claim the residual value of the Division 43 Allowances as a balancing adjustment which is approximately $4,500 p.a x 37 years = $166,500. In addition, provided they have not received a consideration from the tenant to make good, they can also claim the costs they have incurred to demolish the fit-out and make good the premises.

How Can Mitchell Brandtman Help a Landlord Identify & Claim Capital Allowances Resulting From a Tenant Abandoning their Fit-out ?

Mitchell Brandtman can:

• Review all existing documentation relating to the fit-out.

• Visit the site to gain a comprehensive understanding of the fit-out.

• Measure & provide an estimate of the historical construction cost of the Division 43 assets.

• Provide a photographic record of the fit-out including all plant and equipment.

• Prepare a Capital Allowance Schedule reflecting the Capital Expenditure incurred by the tenant. • Calculate the value of the balancing adjustments resulting from the demolition of the fit-out.