It’s time to maximise the return on your investment.

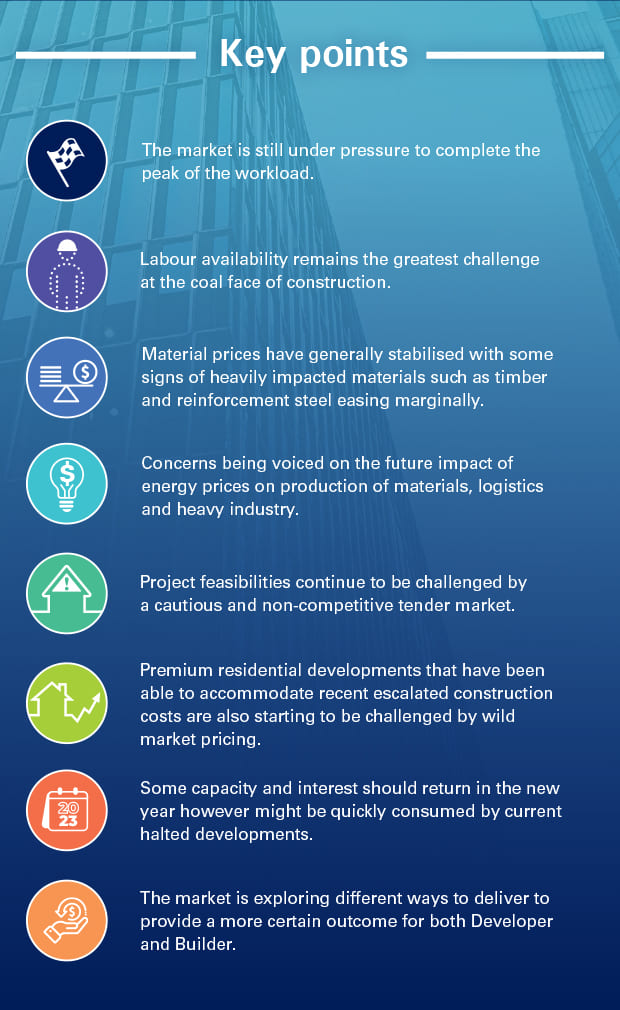

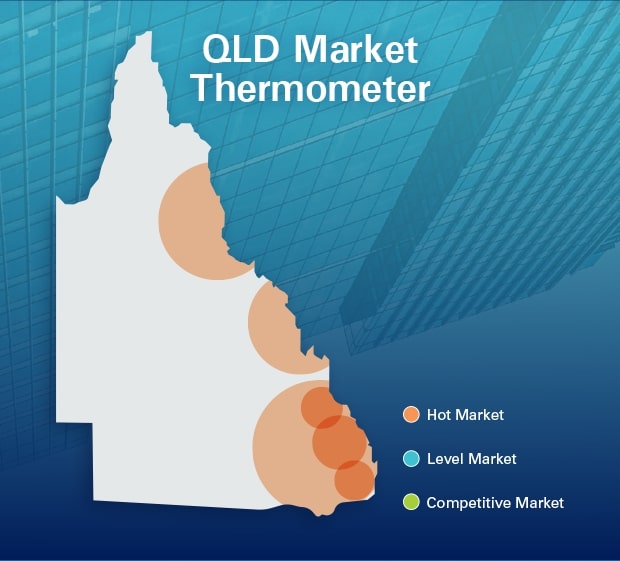

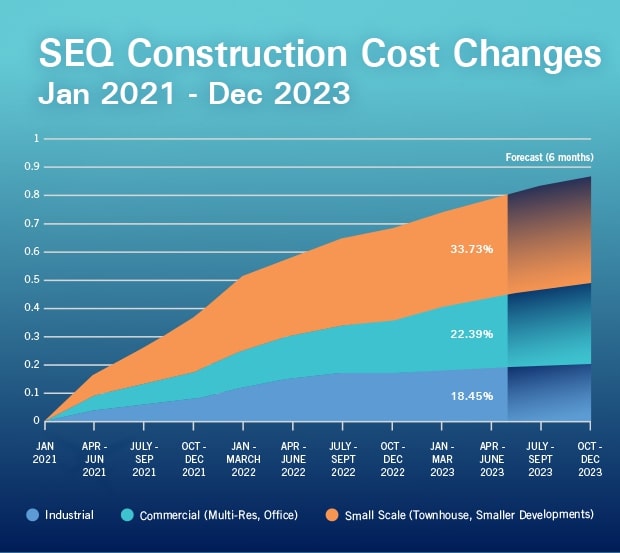

Head contractor confidence, capacity and appetite for risk continue to wreak havoc across larger scale private developments, with attention being largely turned to the less speculative public spending commitments mounting on the horizon.

This is distinguishable from the small scale residential and industrial sectors which both appear to have rebuilt enough competitive tension across trades to keep the fair value for money position somewhat in check. This will create a pricing divide and we expect to be dealing with a ‘two-speed’ economy in terms of construction pricing until healthy competition returns to the mid and upper tier tender market – at both a sub-contract and head-contract level.

Public spending commitments across all parts of Queensland are at stimulus measure levels, with a clear sight of work until post Brisbane Olympics and Paralympics. This will absorb more than the capacity we currently have to deliver our current volume of work. Regional areas are already struggling to make anything not just ‘stack up’ but actually meet the fundamental fair value equation.

Opposing forces usually lead to sparks, which we have already seen across the institutional and private sectors. However expect that to remain the case across the typical tender market for some time yet – and for it to likely get worse before it begins to improve.

Projects that are successfully traversing the feasibility and procurement minefield are leveraging strong relationships or simply have the ability to be dynamic based on their own unique set of challenges.

We will again this year, be sharing our knowledge with you and your team members at our Financier Education Workshop.

We’ve created this workshop for Financiers who would like to gain a more thorough understanding of what a Quantity Surveyor does and how we help Financiers and their clients on a project.

The workshops will be held at: Level 11, 66 Clarence Street Sydney 2000

If you want to better assist your clients, then this workshop is for you!

This half day workshop will cover off on topics such as:

Click on the workshop dates below to register: (please ensure you list your attendance date in order of preference)

Cost to attend the workshop is $75 (ex GST)

Please feel free to share this invitation with your colleagues should it be of benefit to them.

Numbers are strictly limited so register your interest now to avoid missing out.

The Mitchell Brandtman Financiers’ QS team.

Please contact Lisa Hemming if you would like to be added to the waitlist lhemming@mitbrand.com or 3327 5021

Back by popular demand but ramped up by 1000% !!

We will again this year, be sharing our knowledge with you and your team members at our Financier Education Workshop.

We’ve created this workshop for Financiers who would like to gain a more thorough understanding of what a Quantity Surveyor does and how we help Financiers and their clients on a project.

If you want to better assist your clients, then this workshop is for you!

Date: 11th May 2023

Venue: Dexus Place, Level 31, 1 Eagle Street, Brisbane

Time: 8:30am – 1:00pm

Morning tea and lunch is included

Understanding our Reports

Initial Reports

Progress Assessment

Distressed Project Situations

Dealing with Unfixed Materials, Deposits, etc

Budget Review Process

Market Cost Review

Benchmarking

Detailed Estimating and Bills of Quantities

Procurement and Contract Types

Traditional Fixed Price Style Contracting

Construction Management and Cost Plus Contracting

Owner Builder / Developer Builder

Early Contractor Involvement (ECI)

This workshop will also include case studies that will be based around a mock site inspection etc

Please email Lisa Hemming to book your attendance lhemming@mitbrand.com

In the past two years, we have seen a significant increase in the number of requests for Replacement Cost Estimates, which is a natural trend when building prices dramatically shift – as we have recently witnessed.So, what is a Replacement Cost Estimate and why is now the perfect time to engage a Quantity Surveyor to ensure you have an up-to-date Replacement Cost Estimate?

Put simply, a Replacement Cost Estimate is a measured estimate that a Quantity Surveyor can provide which indicates the cost that must be spent to replace a current asset in the current market should the unthinkable occur. For example, the price that it would cost you to rebuild your home or place of business in the event it was destroyed by flood or fire.

Why is it so important?

Replacement Cost Estimates are crucial for a number of reasons, but the most significant is insurance. An up-to-date Insurance Replacement Cost Estimate ensures that building assets are accurately covered by your insurance provider in the event of significant damage. Given the volatility of the current market, when paired with the increasing inflation rate, it is imperative to have an accurate Insurance Replacement Cost Estimate on your building assets. Furthermore, our report will provide a comprehensive Replacement Cost Value of the property in the event of a natural disaster or accident, so the property owner will not be left out of pocket should they need to rebuild.

Having a considered estimate position on your asset will also ensure you are not over insuring and paying unnecessary premiums – because as we know, not all assets are the same.

How do we calculate your Replacement Cost Estimate?

Our team of expert Quantity Surveyors will provide a comprehensive replacement cost value of the subject building for insurance purposes, including costs relating to demolition of the existing building, professional fees, estimated construction costs, and cost escalation.

Contact us to ensure your building assets are accurately covered. assetservices@mitbrand.com 1800 808 259

Climate change is a major international issue. All levels of government in different countries are setting greenhouse gas omissions targets that to most people seem unachievable.

As this is a major international issue, let’s narrow it down and focus on Brisbane CBD.

Brisbane’s CBD is full of power hungry buildings that need to be tamed. There are a lot of news stories going around at the moment describing the very poor state of the energy efficiency of Brisbane’s office building stock. You just need to take a walk through town to see the extent of the problem, tower after tower reaching towards the sky with small windows dotted through the solid external walls. Why were they designed that way? Well, because that’s the way it was done in the 1970s and 80s and unfortunately they relied on very big old-school plant and equipment to provide the cooling and power requirements that are needed to run such large structures.

According to the Commonwealth’s NABERS register, close to half of Brisbane’s CBD office towers score poorly to very poorly. In other words, these old towers are sending tonnes of carbon dioxide into the atmosphere.

For the landlords of these old towers, this problem is getting bigger by the minute. These landlords will struggle to attract top quality tenants who are willing to pay top dollar because their buildings are not ægreen’ and let’s face it, old fashioned. This means they may have to accept decreasing rents and increasing maintenance and running costs. This is not a good formula.

Even if the owner of one of these old towers wants to sell, they may find it difficult to make a profit. The reason for this is that purchasers will look at two main things; the first is the rent, which is lower than it could be and the second is the running and maintenance costs, which are higher than they should be.

As I see it, these problems facing the old Brisbane CBD office stock have two solutions. The first solution is to demolish these towers and rebuild. A long demolition, re-design and re-construction period, coupled with the huge holding costs makes this option not very attractive. The second solution is the æR’ word that is being thrown around a lot at the moment û retrofitting.

So what is retrofitting? Wikipedia describes it as follows:

Retrofitting refers to the addition of new technology or features to older systems.

In other words, you need to pull all of the plant and equipment out of an old building and replace it all with more energy efficient alternatives. Sounds scary hey?

Well, apart from the difficult logistics involved and the cost of retrofitting, the benefits for the property owner can be huge. Not only will the value of their property increase, but depending on the extent of the retrofit, the building’s energy consumption can drop dramatically, resulting in a massive reduction in the buildings running and life cycle costs.

Retrofitting is an expensive exercise, so let’s look at the issues and see how it can work.

Tax Breaks for Green Buildings? The Gillard Labour Government has been in consultation with industry in order to define the specific criteria and incentives for property owners to implement energy efficient retrofits over the past few years. The preliminary decision was, if the building qualified for the tax break, the building owner could be eligible for a one-off bonus tax deduction of 50% of the cost of the eligible assets and / or capital works. This would have been a great incentive for building owners to retrofit their building but the Gillard government scrapped this tax break before anyone could take advantage of it.

State Government Assistance? The New South Wales and Victorian state governments have brought in æEnvironmental Upgrade Agreements’ which help landlords finance the retrofitting process. Older Sydney and Melbourne office buildings are already ôgoing greenö. Unfortunately for Queensland there are no such agreements in place and with the state of the current budget, this is not likely to happen any time soon.

However, Low Carbon Australia (LCA) is helping to fund these specific types of projects. LCA is a public company set up by the Australian Government to help deliver energy efficient retrofits with the aim of reducing carbon emissions. LCA is offering competitive market rate finance to developers who wish to undertake an energy efficient retrofit , so there is some help at hand.

A further issue is created by the logistics of the retrofitting process. There are two main ways of doing this – The Fast Way or the Steady Way.

The Fast Way – Move everyone out of the building at the same time. Once everyone is out, the building undergoes a transformation from an old tower to a new greener, more attractive tower. The main advantage of this method is the speed. The main disadvantage of this method for the building owner is that they will not receive any rent whilst the retrofit is under way.

The Steady Way û Retrofit one floor at a time. The advantage of this method is that you can still receive rent whilst each floor is being retrofitted with new glazing, AC & electrical equipment etc. The disadvantage is the constant decanting of office workers to either other floors or finding off-site temporary accommodation. The other disadvantage is that this method takes a longer time frame.

This may seem like taking a risk, but with risk comes reward.

Two property developers have made news by retrofitting their old Brisbane office towers very successfully.

The first retrofit was the Magistrates Court back in 2005-2006. The building was purchased in 2005 by Citimark for $7 million. The following year Citimark spent $15 million doing a complete Retrofit transforming an old office space into a cleaner A-grade office space. The first result was that all floors were leased upon completion in November 2006. This building was then sold to GE Capital in 2007 for $55 million.

The second retrofit was 26 Wharf Street which was built in the 1980s and was purchased by the Harvest Property Group in 2010 for $7.95 million. The Harvest Property Group then spent $1.5 million on the retrofit. The building was sold for $4.3 million more than the 2010 purchase price. The building energy consumption was reduced by more than 40% and the NABERS rating of the building increased from zero to 4-stars.

As shown by the two above examples, retrofitting an old office tower into a clean, green, A-grade office can be amazingly successful with huge profits to be made.

This type of project may also be very profitable for developers who may prefer to hold on to their properties. Not only would they benefit from reduced running costs and increased rents, they would also benefit from significant tax depreciation benefits.

In order for building owners to maximise their tax depreciation entitlements, they will need a detailed asset register linked into the tax depreciation report for the property, even if they already have an existing tax depreciation report. Depending on how long a property owner has held an old office tower, the tax benefits of writing off energy inefficient and/or redundant plant and equipment could go a long way to helping the owners pay for the retrofit. Once the retrofitting starts, the property owners can then single out every individual item of plant and equipment that has been removed and write-off its remaining value.

For more information on the tax depreciation benefits of retrofitting and old office tower, contact Luke Anthony, Asset Services Manager, Mitchell Brandtman, Tel. 07 3327 5000.

Joining team MB in 2006 as cadet Quantity Surveyor, Caitlin’s industry experience spans a diverse range of sectors and project types.

Known amongst her peers as one of the best 5D Cost Planners on the planet…yes the planet, Caitlin is, and has been a strong advocate in the use of BIM and digital technology to streamline and improve project delivery.

Mitchell Brandtman is built on people and relationships. Caitlin embodies these ideals and will continue to be instrumental in leading the business, working with our clients, mentoring team members, and sharing her wealth of knowledge on a day to day basis.

Bring on 2023!

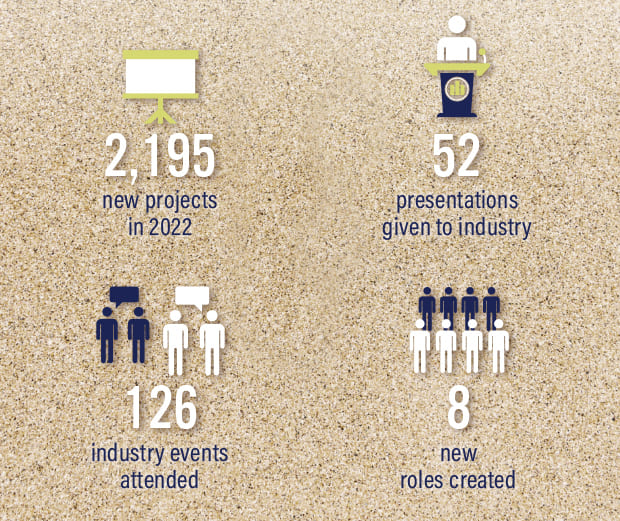

What can you expect from team MB this year?

– Financier Education Workshops

– Presentations to industry

– Quarterly Construction Cost updates ( Subscribe to our newsletter )

– New team members

– Delivering 53 years of industry experience to you on your projects

We look forward to working with you in 2023!

Today’s cautious tender market continues to produce uncertain cost and time results, which is in turn, challenging project feasibilities and the overall value for money equation. There are no clear signs of this divide between cost and affordability easing in the short term, particularly with the festive season upon us, which is historically a difficult time to approach the market.

The reality is that tomorrow’s developments will need cost and time certainty to progress, so Asset owners are starting to look at innovative ways to deliver, including adaptive reuse of existing assets to avoid challenges faced on sites currently.

It is also a timely reminder that existing building insurance values will be challenged by recent rapid construction price changes nationally. Contact our team to ensure you have an up-to-date Insurance Replacement Cost Estimate of your building asset.