This Mitchell Brandtman Quarterly Cost Solutions has been put together

to keep you informed on market movement and the impact on construction costs.

This quarter, we are continuing our efforts to help clients manage shifting costs and

expectations. The constantly evolving market and differing performance between

States and regions highlight the importance of our commitment to providing highly

detailed and transparent cost analysis.

Australian Review

Seasonally adjusted figures from September show that while the value of total

Australian residential building was flat at $8.04b, total dwellings approved rose

4.4%. While dwellings excluding houses also rose for the month, they remain

consistently down over 12 months.

Overall, Australia is moving away from the period when property values increased

faster than construction cost escalation. This price volatility is why we encourage our

clients to obtain detailed cost estimates from an early stage.

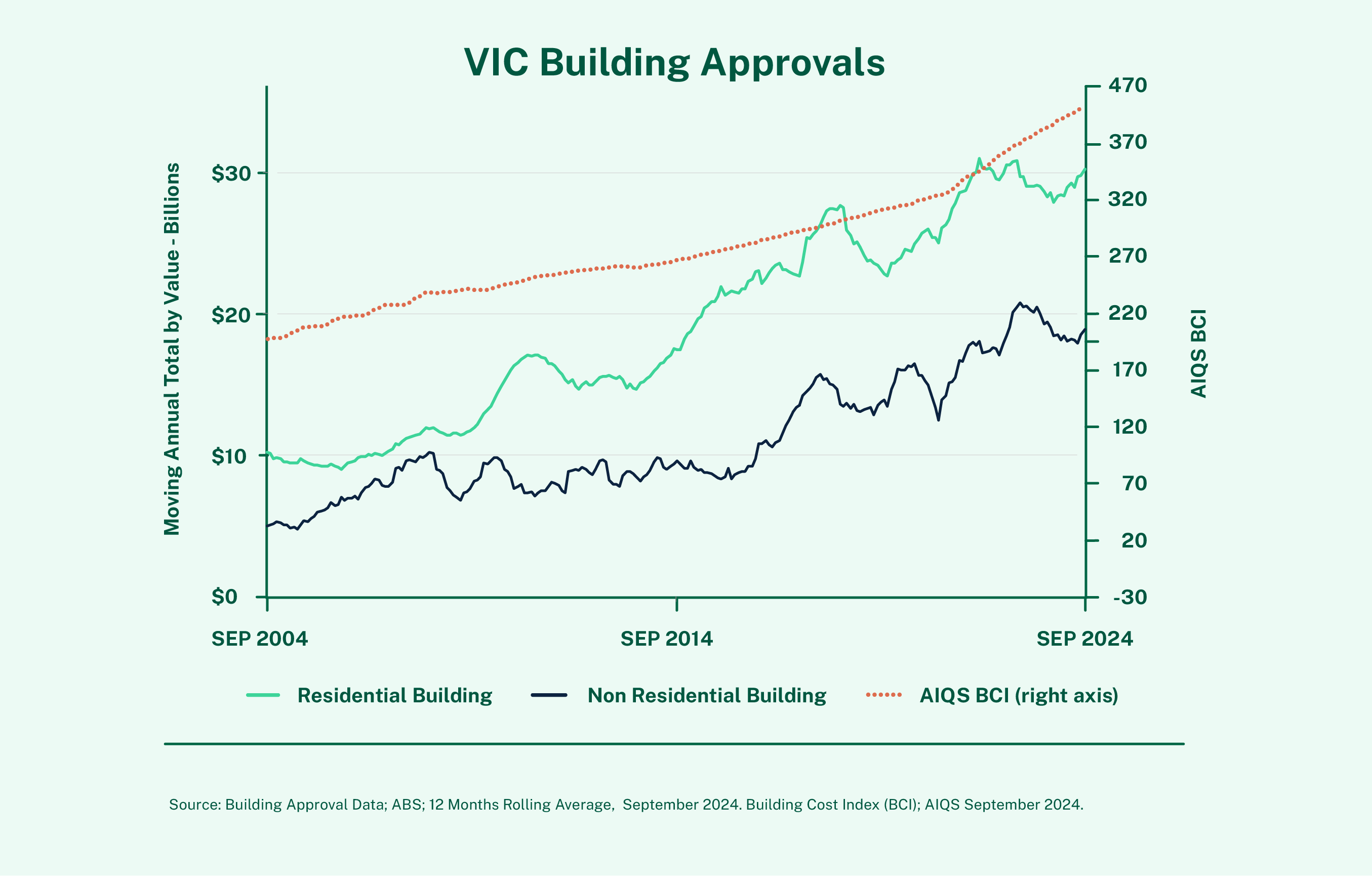

Victoria

Local Update

The construction market in Victoria is seeing slow but steady residential

developments and limited activity across apartment and office towers.

Industrial works are peaking, childcare and medical centre works are ongoing,

but new public and infrastructure projects are experiencing uncertainty at this

point in time.

Quarterly Result

Managing Costs for Victorian-based Projects

With labour and material expenses changing constantly for Victorian projects, we

make a point of asking, ‘What if?’

When conducting feasibility reports, we review a range of project options, including

repurposing, extensions and commercial opportunities. Value engineering and

budget control are also high on our radar when helping developers explore their

options.

Generally, labour and materials comprise 70% of project costs, with the remaining

expenses going towards site management, insurance, safety etc.

When we prepare material options appraisals, we consider financial and non-financial

criteria so we can find the best value alternatives. This happens on a

project-by-project and location-by-location basis, so we can save our clients from

under/over capitalising while ensuring the finished product appeals to the target

buyer.

The cost of materials is changing. For example, bricks are less cost-effective than

they used to be, and there have been price fluctuations in timber over recent years

due to bushfires in different locations around the world. When we work with clients,

we explore the material options that make the best sense right now, whether this

means buying locally or importing prefabricated components.

Life-cycle costing also comes into play with quantity surveying — the cost from the

initial acquisition of the site through to development and construction, and then

ongoing maintenance. When we review project costs, we look at lifespan and

durability as well as purchase price. Consider windows for example: will they be

double-glazed, tinted, reflective etc? All these choices will impact long-term costs.

Finally, it is important to remember that every project and building is different. Even

the same building would cost a different amount at different locations because of

factors like ground quality and local utilities.

Cost management is multi-faceted for every element of a build. Even for something

as simple as door handles, we need to review:

Where will they come from?

What they will be made of?

Who will install them?

Coordinating all these costs can be extremely difficult and there is definitely such a

thing as false economy. This is why proper planning and preparation from an expert

team are so important. We carefully review every expense to create a comprehensive

picture rather than a list of ‘per square metre’ prices.

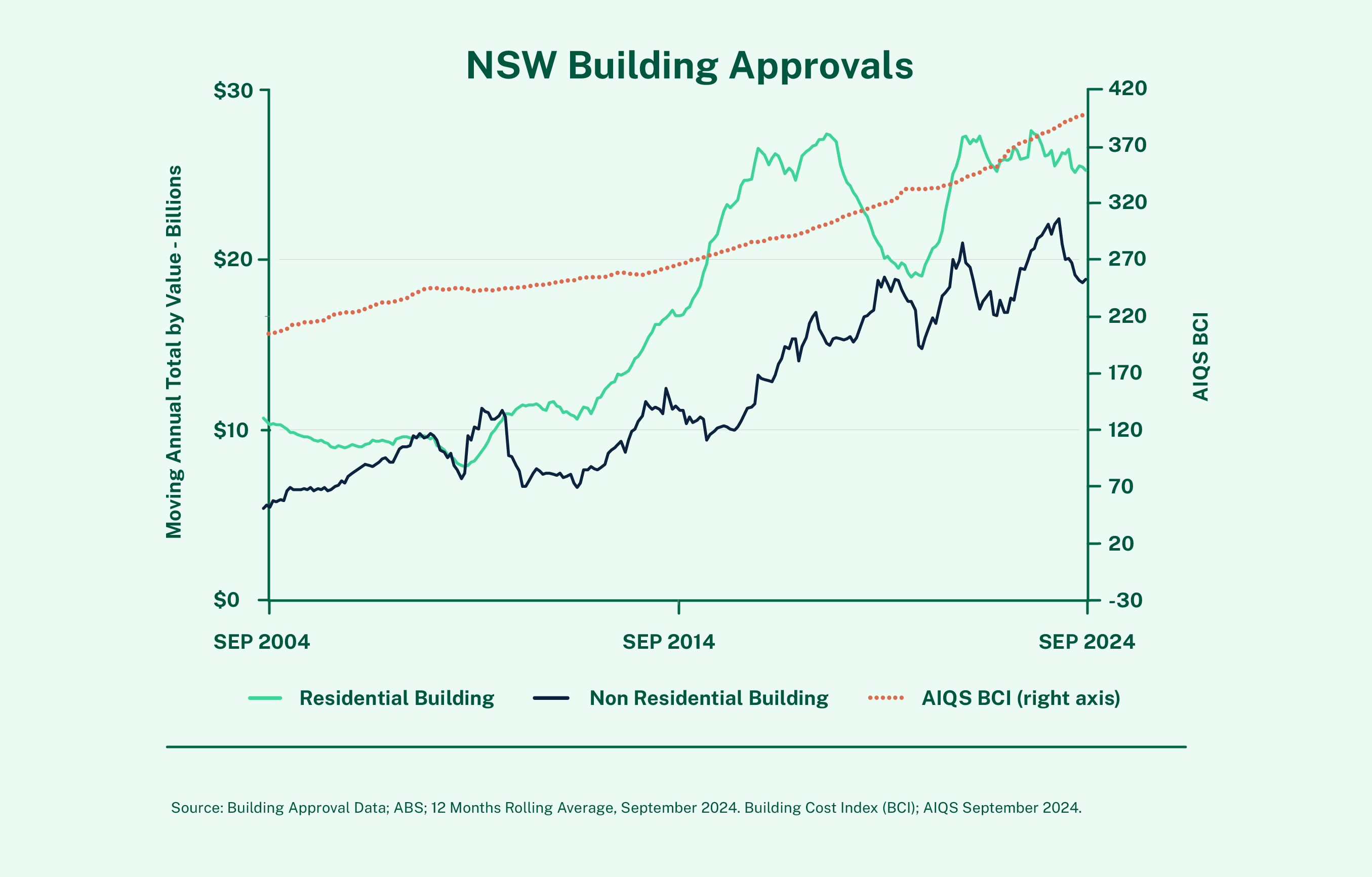

New South Wales

Local Update

The construction market in NSW is operating in two distinct but competing

segments. Government work, generally speaking, appears to be smoother, with good

margins and the capacity for funded variations. Meanwhile, the non-detached

residential market comprises projects that are more difficult to plan and complete,

and where profit margins are shrinking.

Contractors who can move between sectors are finding the Government sector much

more attractive. Government projects appear to have more confidence, flexibility and

funding available. There is plenty of activity and subcontractors have more certainty

about being paid, so those with the experience and skills are actively seeking these

projects.

While residential projects are facing challenges due to the current state of the

market, this doesn’t mean things are impossible. Being forewarned means being

forearmed, so you can have a holistic, upfront understanding of costs before

proceeding.

Quarterly Result

Managing Costs for New South Wales Projects

Developers are increasingly asking about mitigating rising material costs while

maintaining project quality and timelines. With fluctuations still occurring, it is all

about identifying where savings can take place.

We gather information about current costs by speaking directly to subcontractors

and reviewing data from the hundreds of projects we work on, across a range of

sectors each year.

Having real-time information and exploring value-management options helps our

clients access up-to-date material costs. There is usually an alternative to explore

and we can provide the necessary information to better match project budgets and

expectations.

In addition to exploring material and construction costs, Mitchell Brandtman has our

finger on the pulse in relation to the price of labour and contractor availability. While

a great deal of our data comes from spreadsheets, we also spend time actively

reaching out to our networks so we can share cost data that is real and based on

actual projects.

Finally, it’s worth keeping risk management in mind. At this stage, regardless of

project size, contingencies for design and construction are essential. If a project is

forecast at $10 million, an extra $500k (as a minimum) as a safety net makes sense to

prevent setbacks. We understand that this is not the best news when you’re working

on a new development but we set out to be pragmatic and realistic when compiling

reports so everyone is protected.

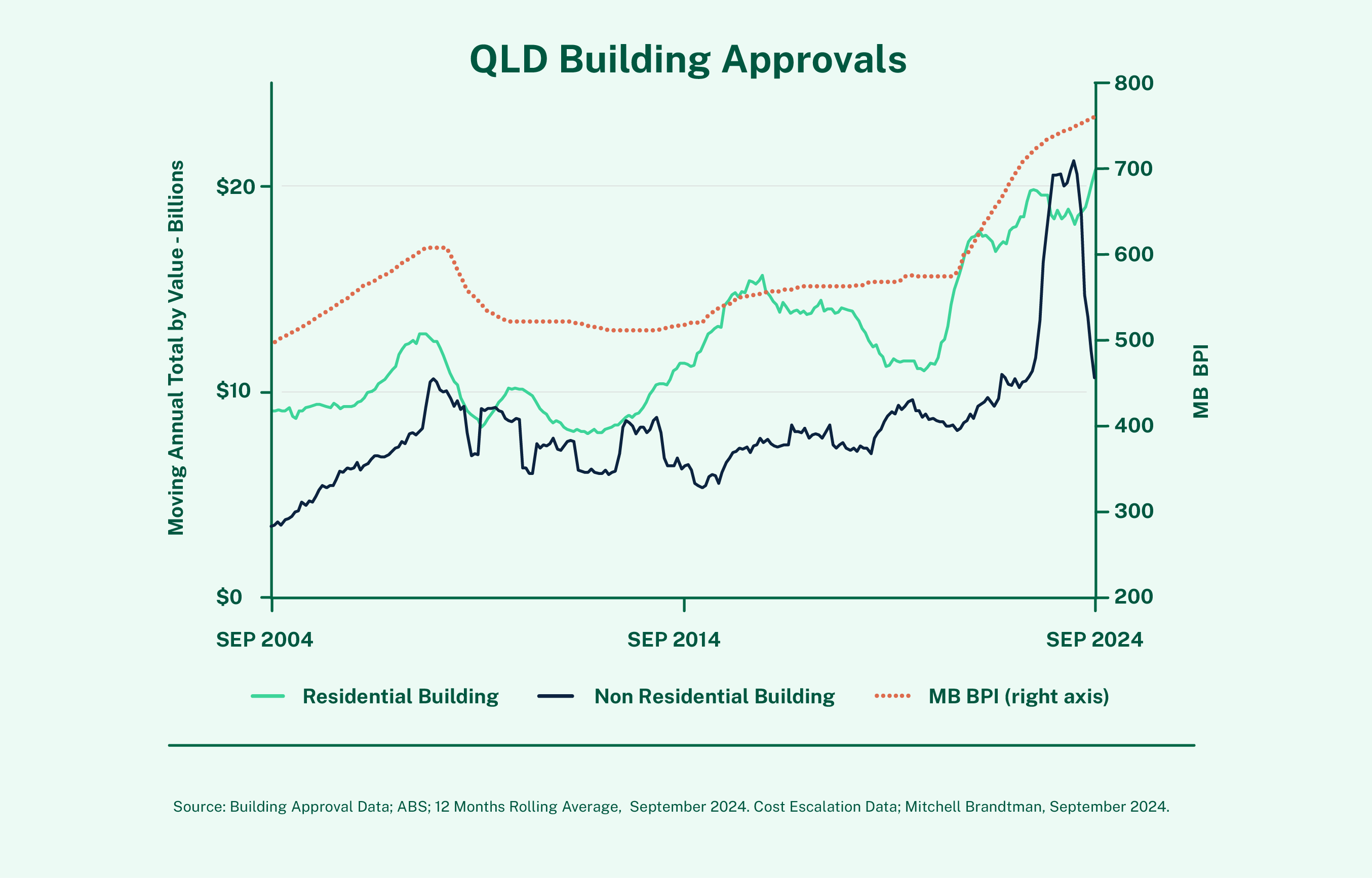

Queensland

Local Update

The Queensland construction market, particularly South East Queensland, is

experiencing a unique set of challenges. Right now, the region is experiencing the

‘calm before the storm’ as it prepares for the pre-Olympics surge of activity.

The outlook is more positive now than a year ago as there is more acceptance around

the fact that conditions have changed and there is no going back. It’s now a matter of

working with what we have got and adapting to the new normal.

Quarterly Result

Managing Costs for Queensland Projects

In 2024, the industry has begun to embrace a shared risk model, where builders and

developers work together to manage risks and costs. When this takes place at a

contractual level, it’s easier for projects to forge ahead. This is a model we advocate

for, with the proviso that contracts benefit all parties.

We are seeing an industry that is more excited to collaborate and support each other,

which is a fantastic trend, especially at a time when cost is a barrier to feasibility and

projects are also struggling when it comes to authority and meeting council

regulations.

When it comes to cost management and reduction, robotics, Building Information

Modelling (BIM) and real-time data have a huge role to play. When subcontractors are

limited and can almost name any price, there needs to be a way to mitigate the cost

of labour. Technology can be applied as an investment that enhances productivity

and eases the burden of other expenses.

At Mitchell Brandtman, we are always on the lookout for ways to do things better and

offset high labour and material costs. Exploring opportunities to leverage technology

is part of this.

For more information, please contact us: Marketing@mitbrand.com